2022 WPTC congress , 2022 Season

“Those who failed to learn from history are doomed to repeat it”

From the presentation given by Martin Stilwell, during the 14th World Processing Tomato Congress (March 2022, held online from San Juan, Argentina).

Talking you today is a particularly difficult task as we are looking hopefully at the end of the Covid pandemic, we are living with an unstable climate, we are seeing really quite extraordinary inflation in our costs, and then finally we have the tragedy of then Ukraine. On the other hand our consumption continues to grow, and I would like to look forward and think together with you as to why production has been unable to increase to meet increasing demand. And to talk a little bit about the impact of massive cost increases which we are bearing will have on our consumers.

Talking you today is a particularly difficult task as we are looking hopefully at the end of the Covid pandemic, we are living with an unstable climate, we are seeing really quite extraordinary inflation in our costs, and then finally we have the tragedy of then Ukraine. On the other hand our consumption continues to grow, and I would like to look forward and think together with you as to why production has been unable to increase to meet increasing demand. And to talk a little bit about the impact of massive cost increases which we are bearing will have on our consumers.

So, if we go back to the pandemic, to remind ourselves of a few dates, on the 11th of January 2020 China reported its first death, and the 23rd of January Wuhan was isolated and on February the 11th it was given a name Covid. Most of us of course know what has happened but it’s important for us to remember we have had 470 million cases and five or six million deaths.

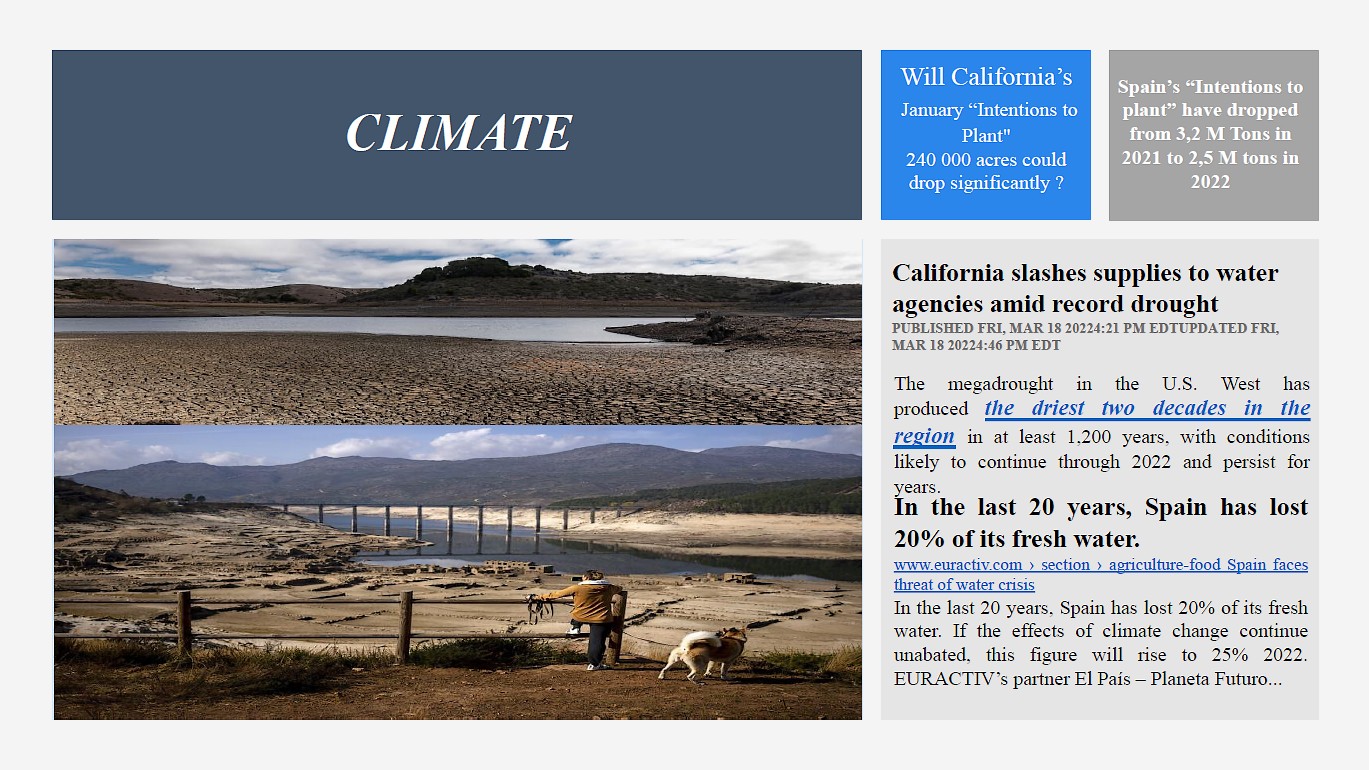

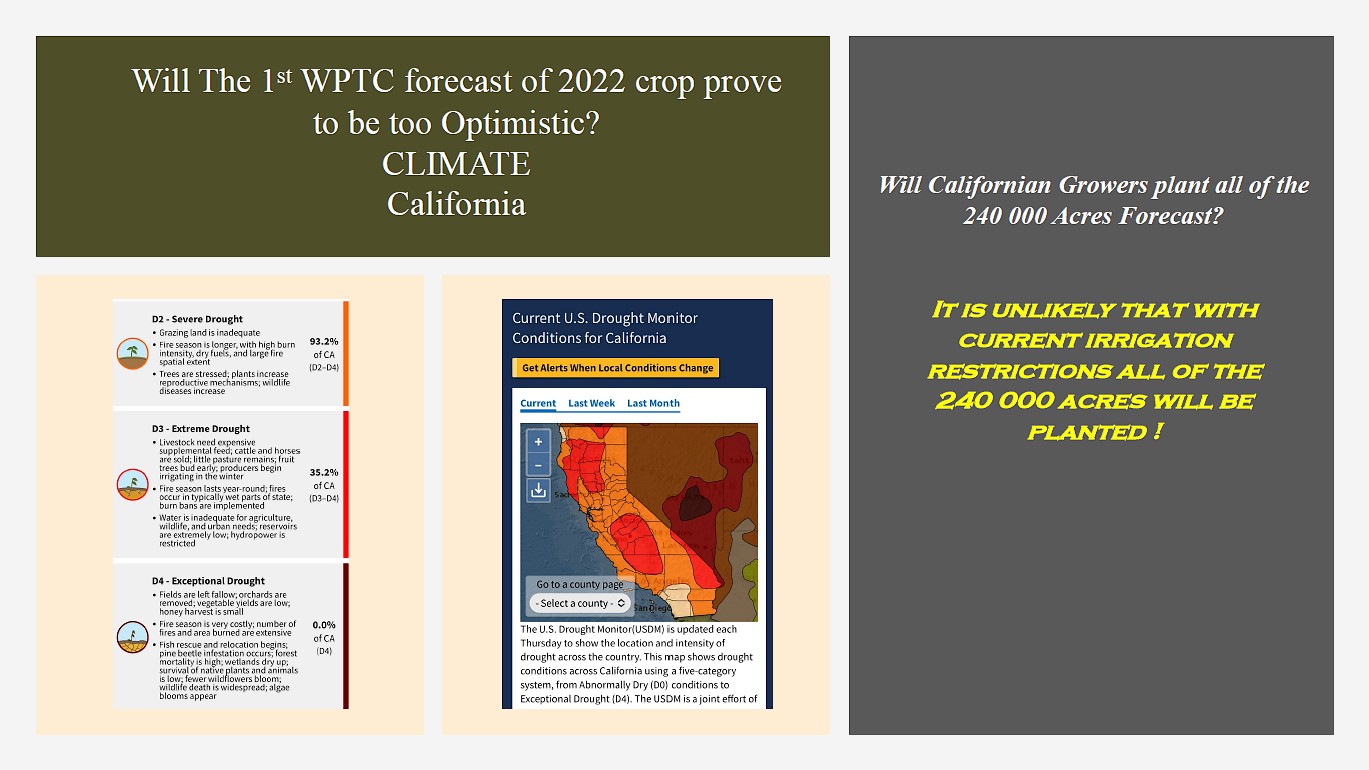

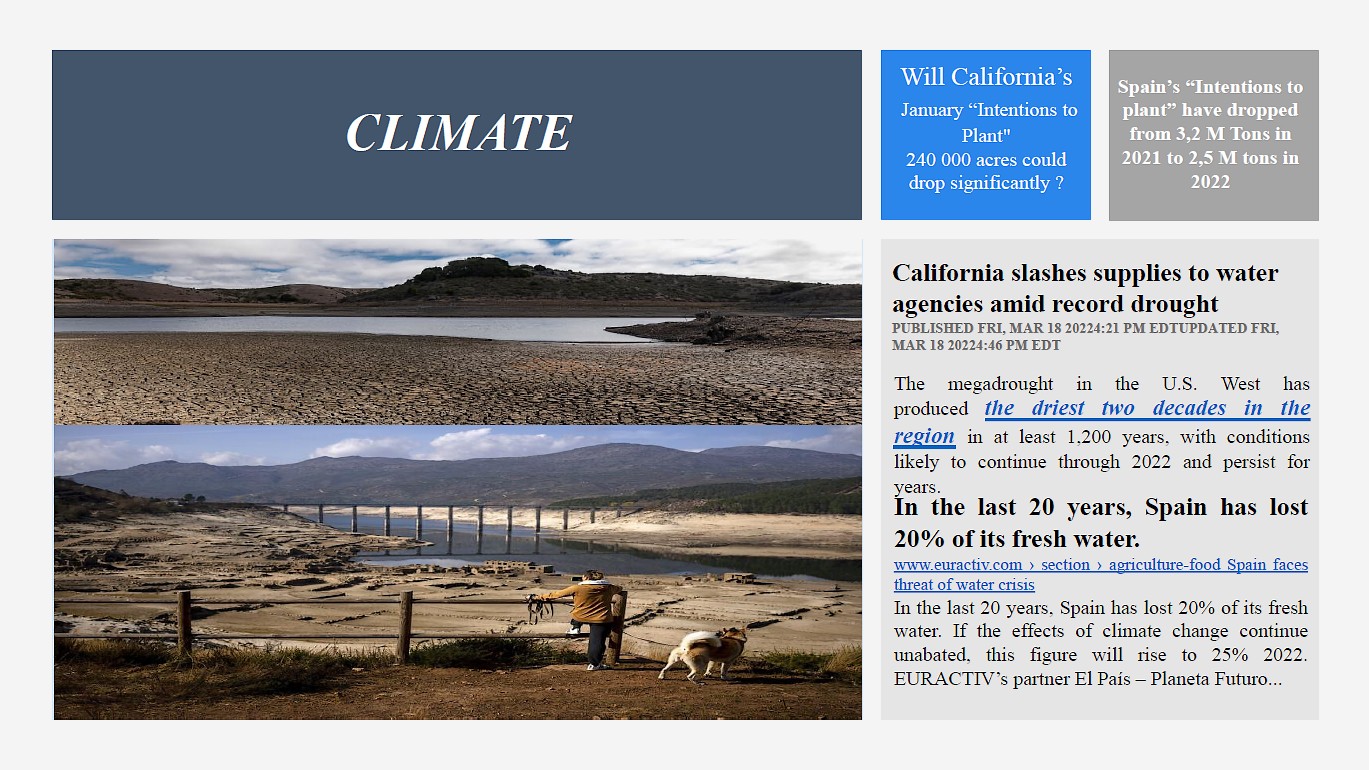

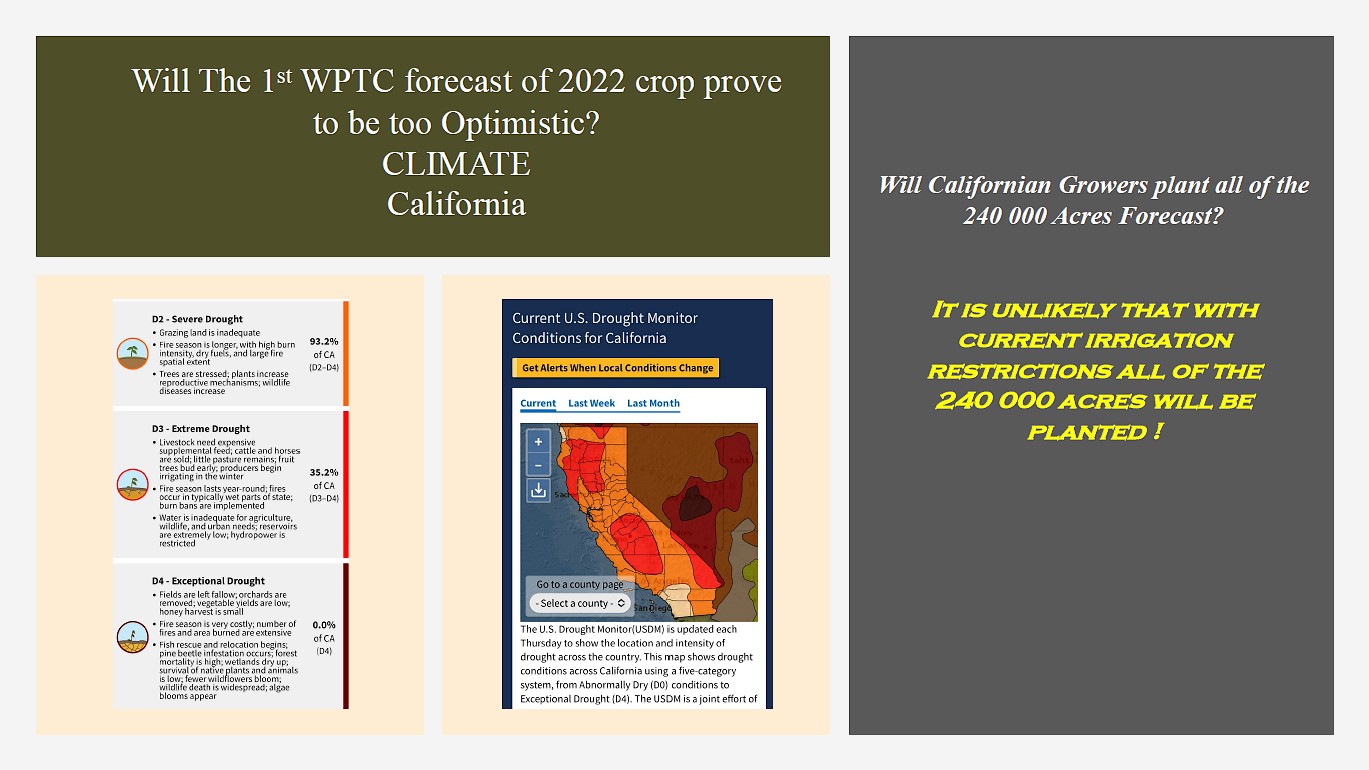

Now what’s climate… We have had a number of extraordinary events which have hit each of the producers over the years but as we start to look at this new crop we have two big factors which are affecting our market: one is California - and that’s the top photograph, and the second one is Iberia – Spain and Portugal, where Spain is more affected than Portugal but Portugal is also affected, and the water is becoming a very key factor for us.

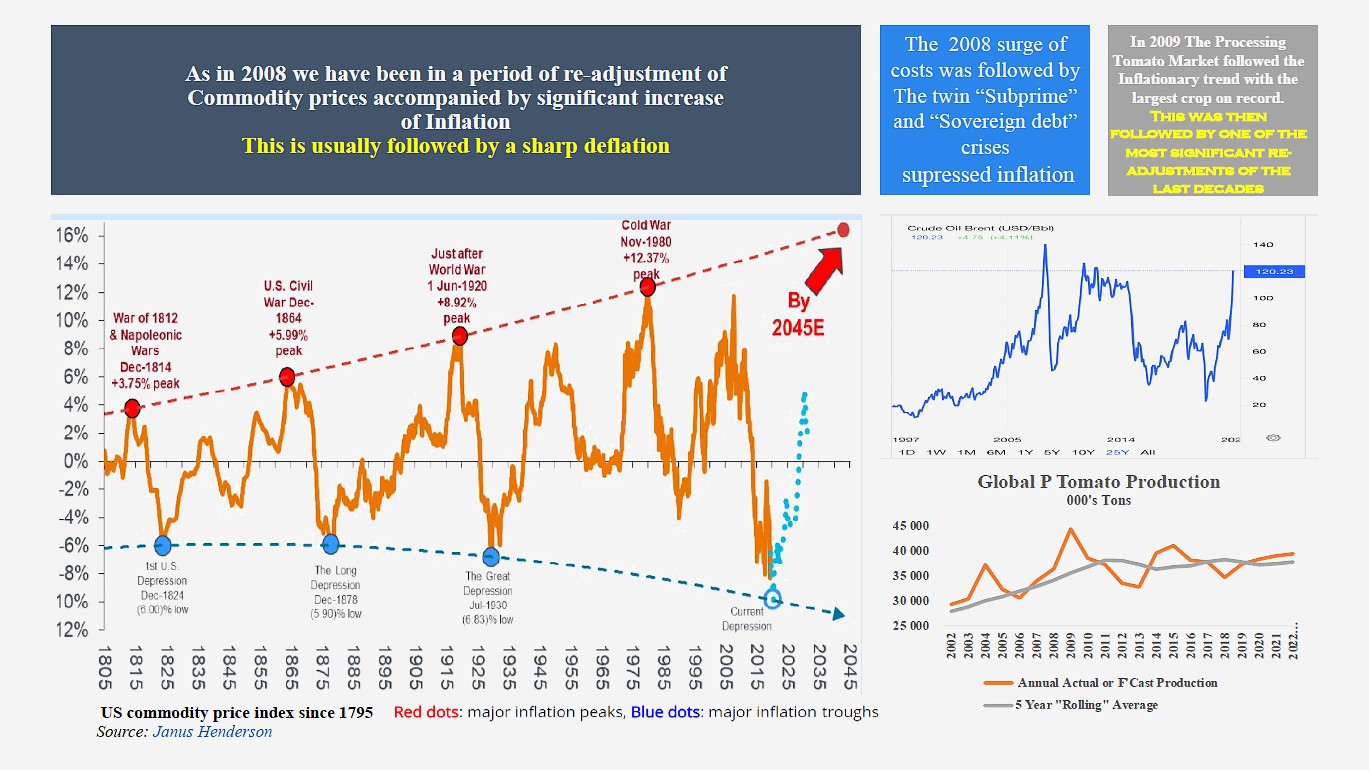

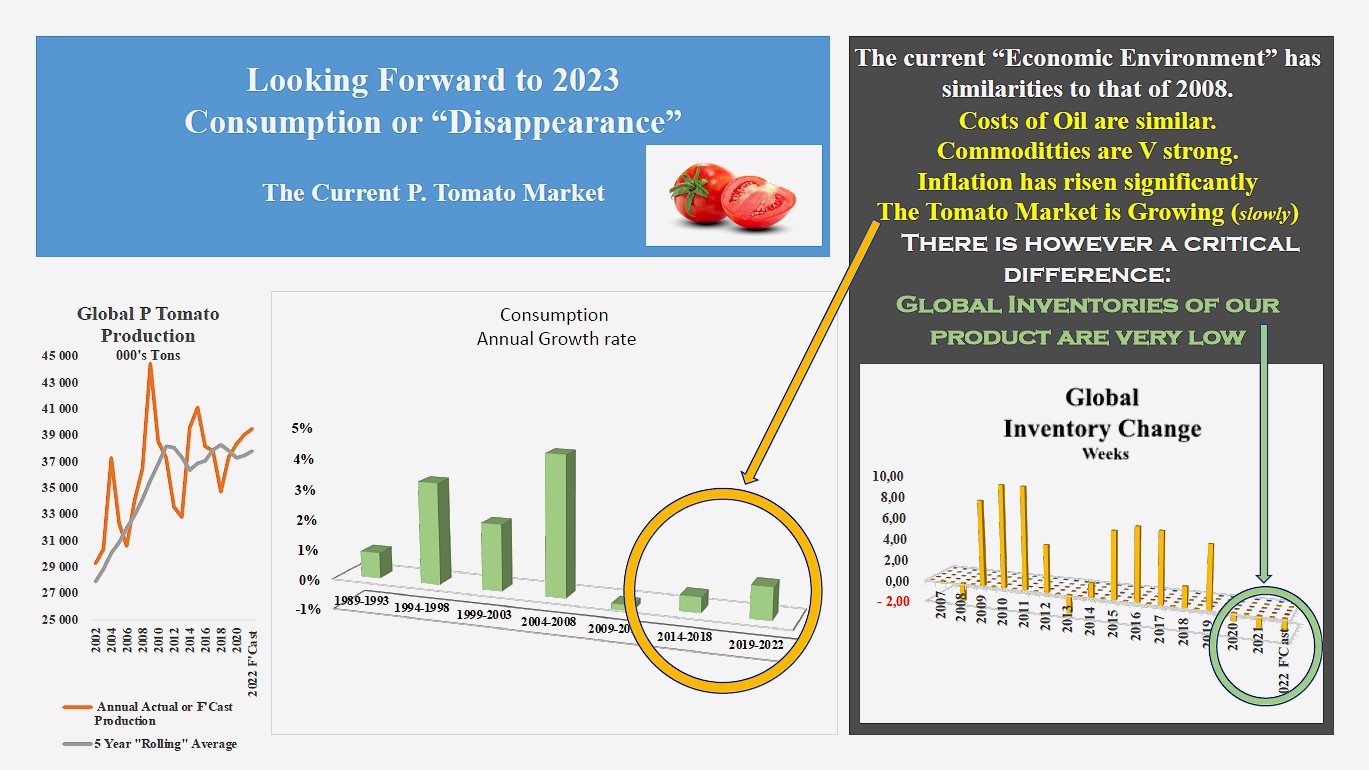

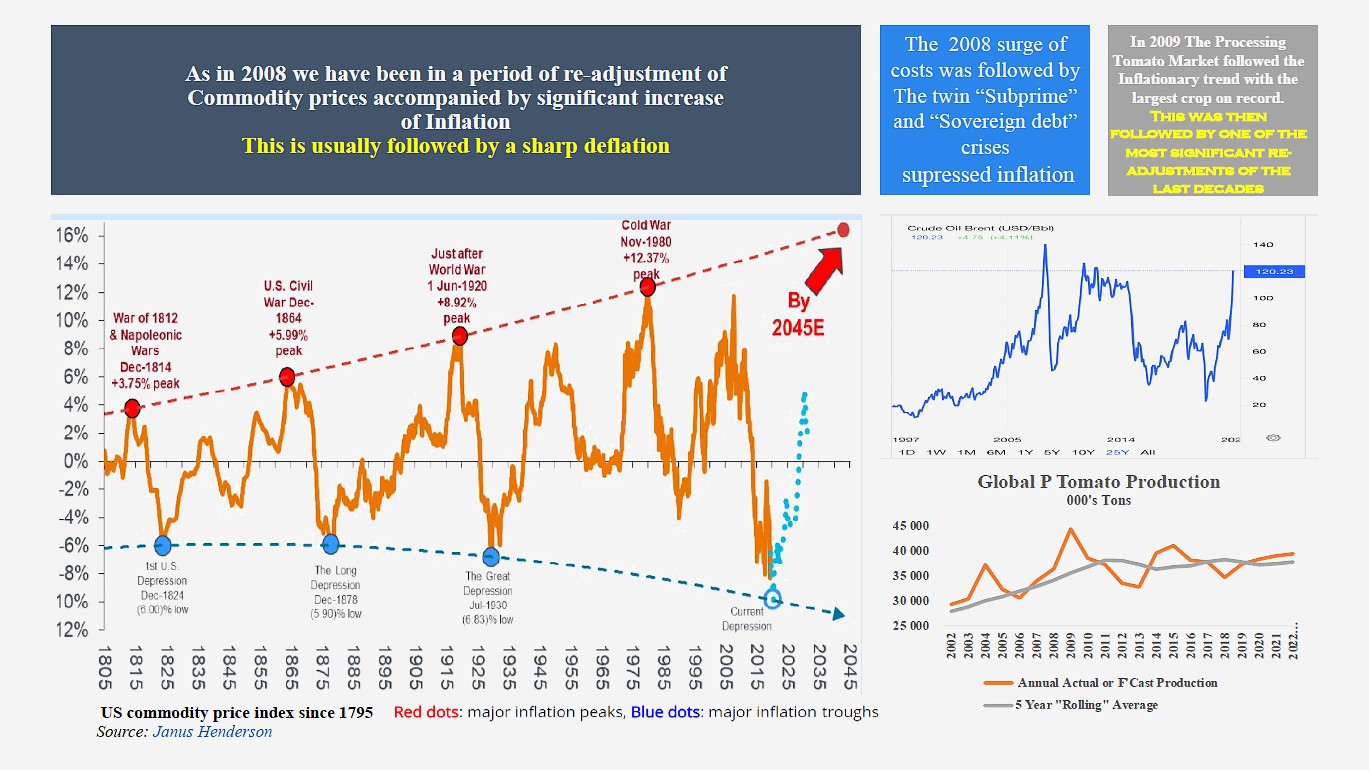

Inflation: I am starting to talk about what’s going on – we have had major peaks of inflation over the years and I found this graph which goes all the way back to the 18th Century, where we have seen peaks of commodity costs increases and inflation; and interestingly the most recent one was in 2008. 2008 is really one of the years I want to focus because if we look at the price of energy which is driving many of our cost increases at the moment, either directly or indirectly, it peaked a very high level higher than it reached this year; and interestingly if we look at our own graph of our own production it coincided with the peak in production in tomatoes and in fact it was the largest year we have ever had in terms of global production – we nearly reached 44 million tonnes.

Now we also have of course as we have talked – and it’s affecting us both directly and indirectly, the tragic war of in Ukraine and of course we have a significant part of the global crop which is produced in Ukraine;

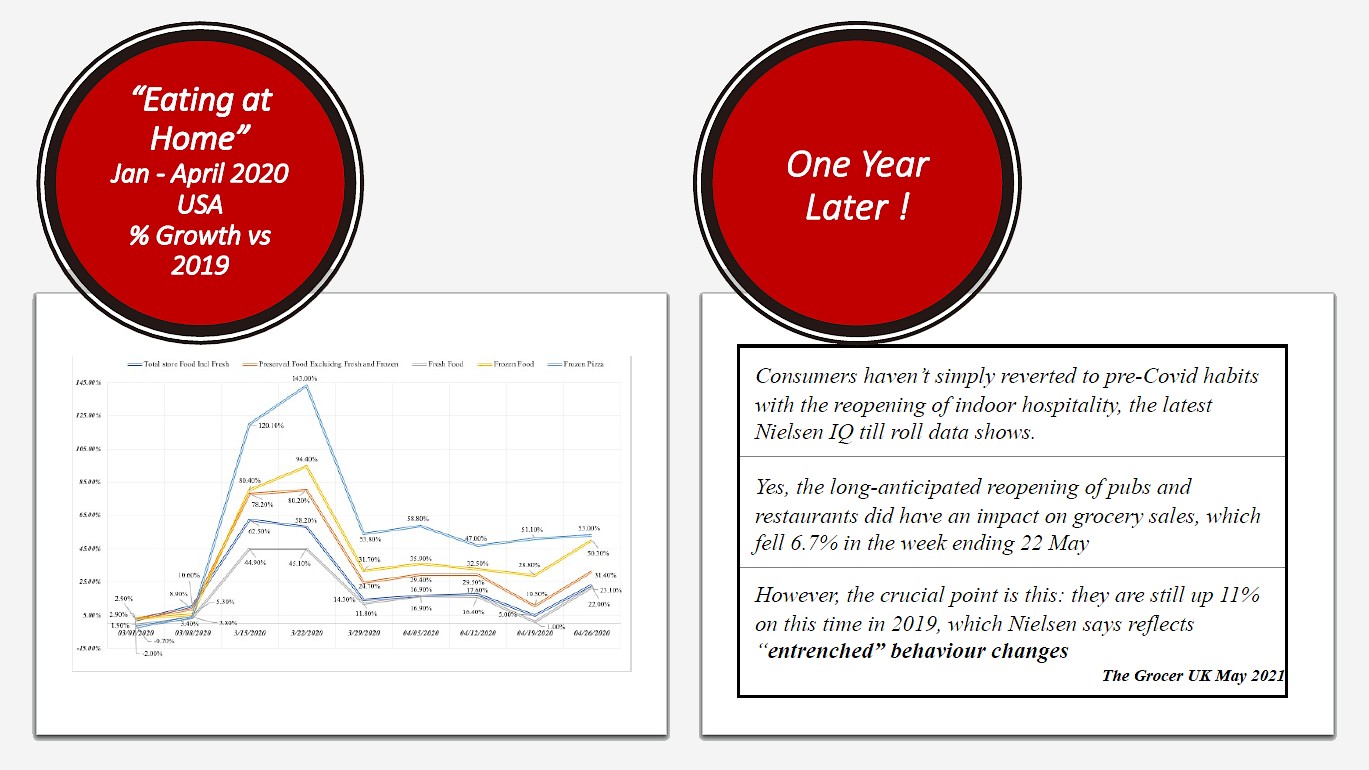

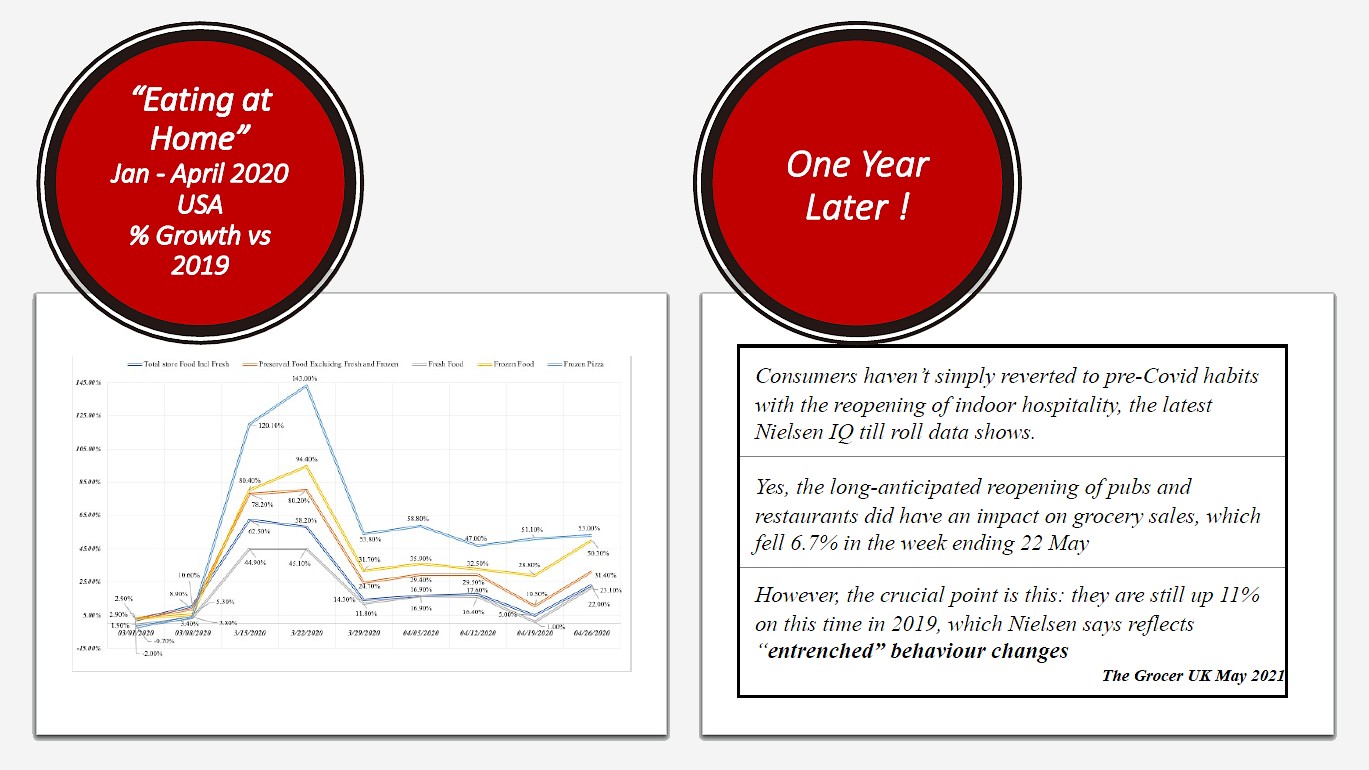

Now going back to a previous presentation - this was in the second year of the pandemic, you will all remember that we saw an enormous surge in consumption of our products which then fell back to a lower level but which was still significantly higher than the one which we had before in 2019. As we look now back at recent annual reports of Campbell Soup a major tomato user and Heinz probably the largest tomato user in the world, they are suggesting that their sales are up by 9%, most of which was gained in the previous years and they expect this growth to continue – not at the same speed as before but to continue to grow.

Looking also at the frozen pizzas sales in the US, it is interesting to see that after a relatively low rate of growth in 2015-2018, we have a surge in growth through 2019, 2020 and 2021 which is interesting; for us it is very difficult to make a pizza if you don’t have tomato sauce so it is a useful indicator for us to see how the market is going.

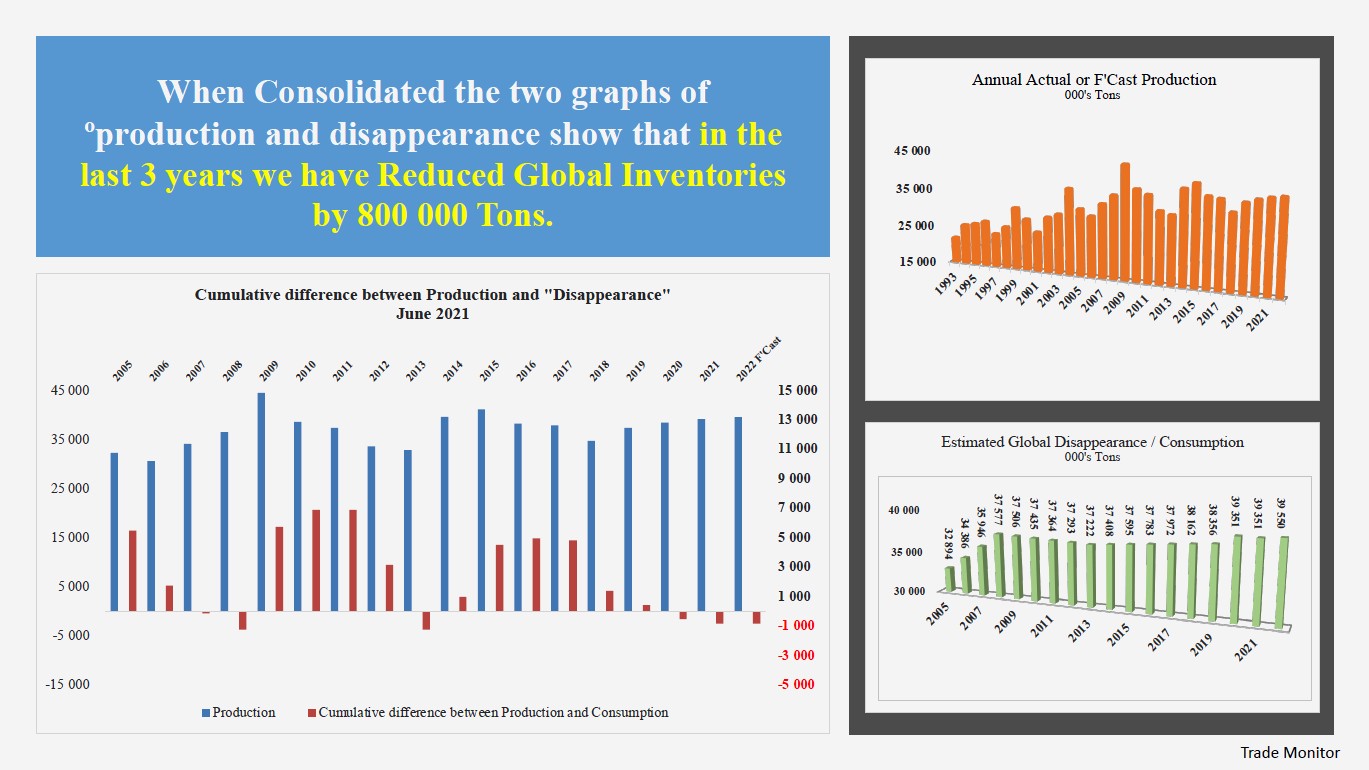

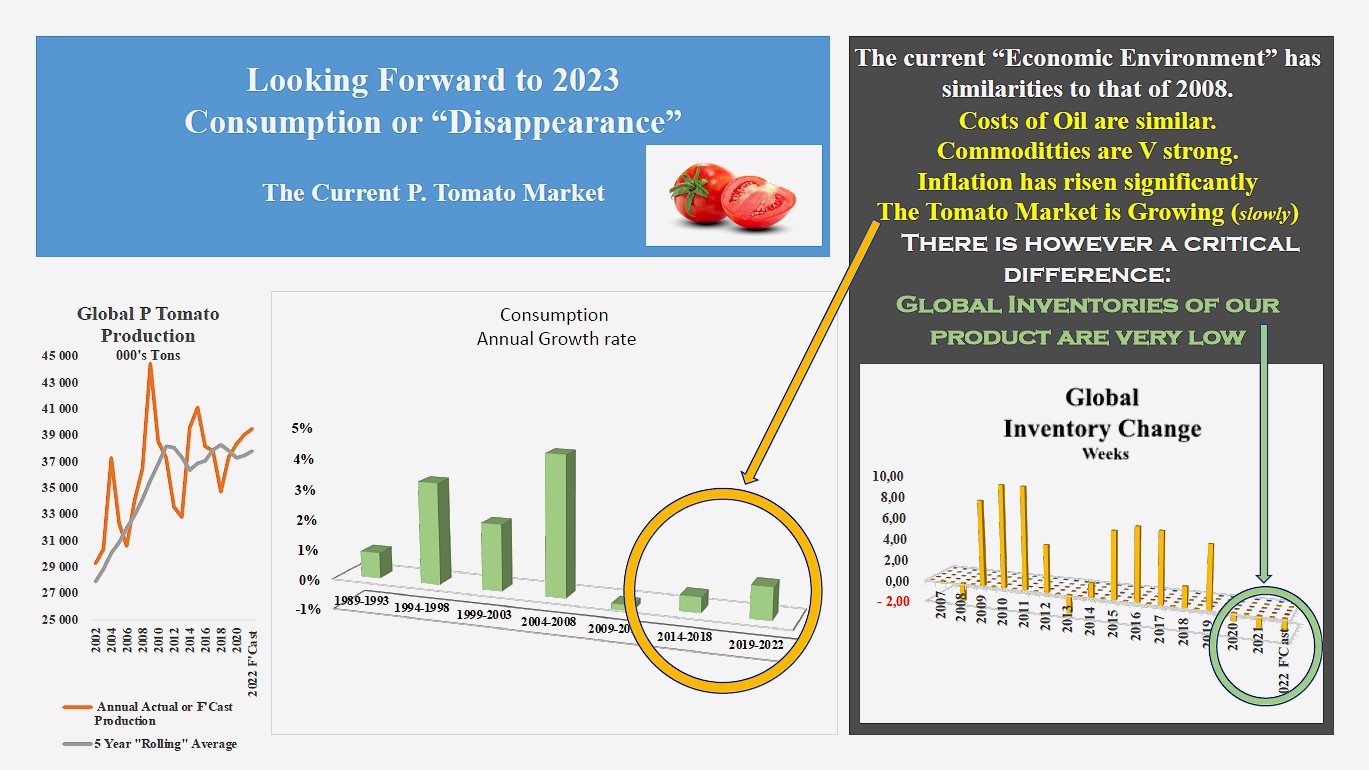

Now I calculate the consumption based on what we produce and an estimation of what is being shipped; and basically we saw we reached the peak of consumption in 2008 after some years an extended period of very significant growth and then the market crashed. I think all of us remember 2009 and 2010, not so much 2009 because that was the year we produced so much but 2010, 2011, 2012 even 2013 were very tough years, and basically consumption remained where it was or decreased slightly; and then looking at what we have produced and what we have left over we have been growing slowly and then in the years 2019 and 2020 we have an increase and then what I think is a slow increase and François Branthôme’s consumption study confirms this. Also if you look at the global imports of tomato paste and puree they have grown quite significantly over the last three years and if you look at the twenty largest importers again there you see significant increases in imports.

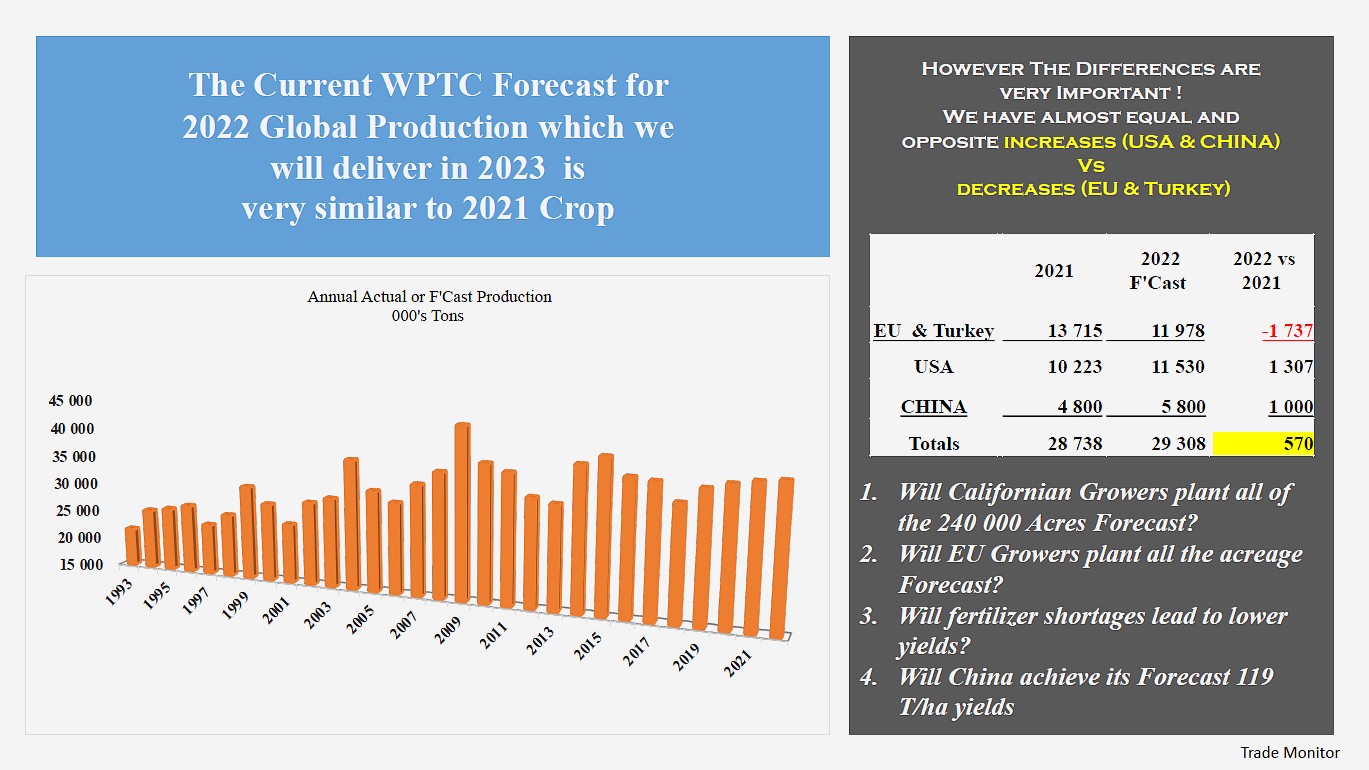

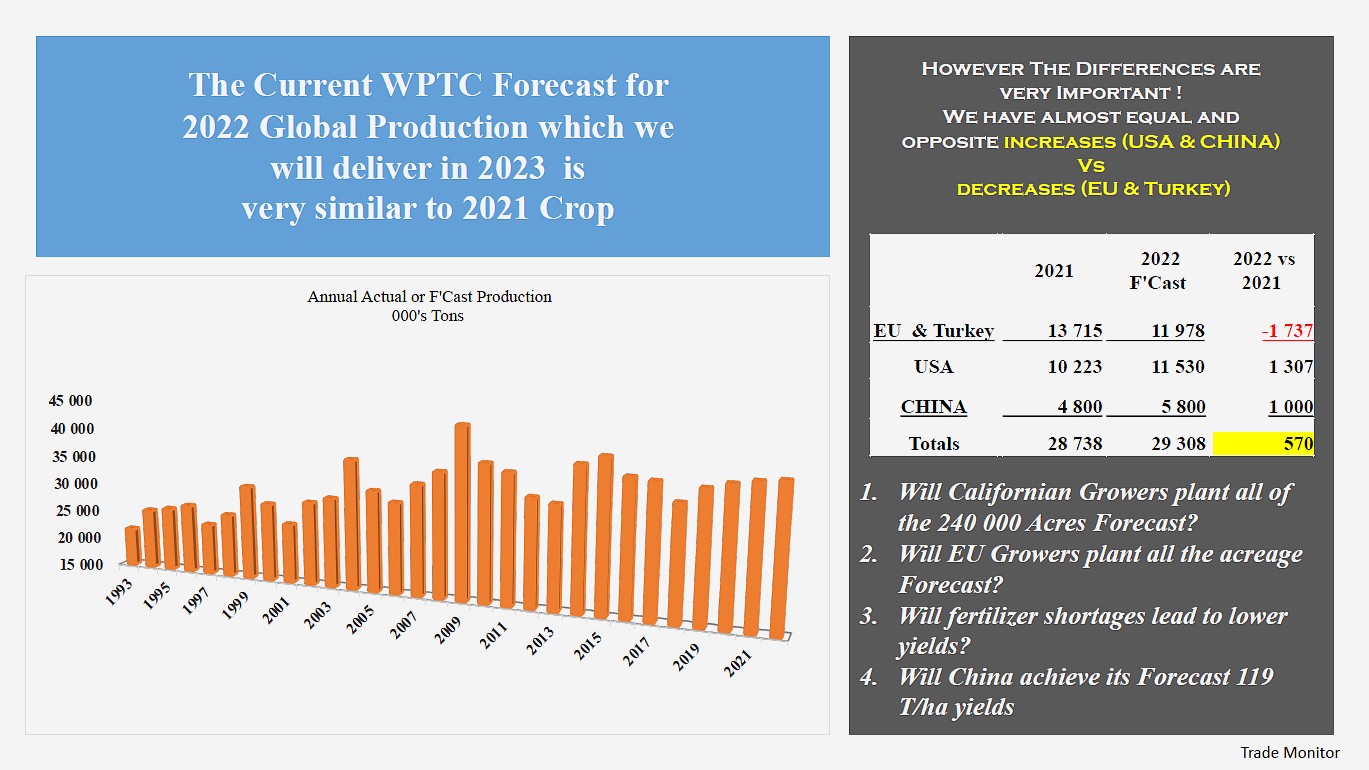

Now as we look at 2022, we have a forecast which is slightly higher than the 2021 crop but basically very similar and it is actually quite interesting to look at these numbers because we have two equal and opposite effects: basically we have the EU and Turkey decreasing significantly and this significant decrease is largely due to the drought in Iberia and a cutback in Italy where Italy had a particularly successful crop last year, and then the counterbalance – you have a significant increase in the US and also in China.

Now as we look at this, basically we have 570 000 tonnes more in our estimate than we had in our actual production of 2021. Now there are three questions or four questions that we need to ask of the current forecasts we have, and particularly in the light of all the changes we have seen recently in the prices of all commodities and the availability and the cost of fertilizers.

The first one I would put is “Will California growers plant all of the 240 000 acres they are forecasting?” California has a very simple first forecast this year, with 240 000 acres and 50 tons per acre, both of which I would judge to be optimistic but we will see – USDA will issue a further forecast in May and I suspect it is going to be a little bit like last year where each forecast will be smaller than the previous one.

Now the EU growers are not immune to everything that is happening as well and we could well see a drop in acreage within the EU; then there is a third point which is important and that was focused on by the excellent presentation by Filippo Roda who talked about the commodity market – will the shortage of fertilizers lead to lower yields?

Then finally there is a comment on the Chinese forecast which is based on an average yield of 119 tonnes per hectare which appears high but to be fair to China, they typically can only produce an accurate forecast during middle to late April, so we may well see some changes there as well.

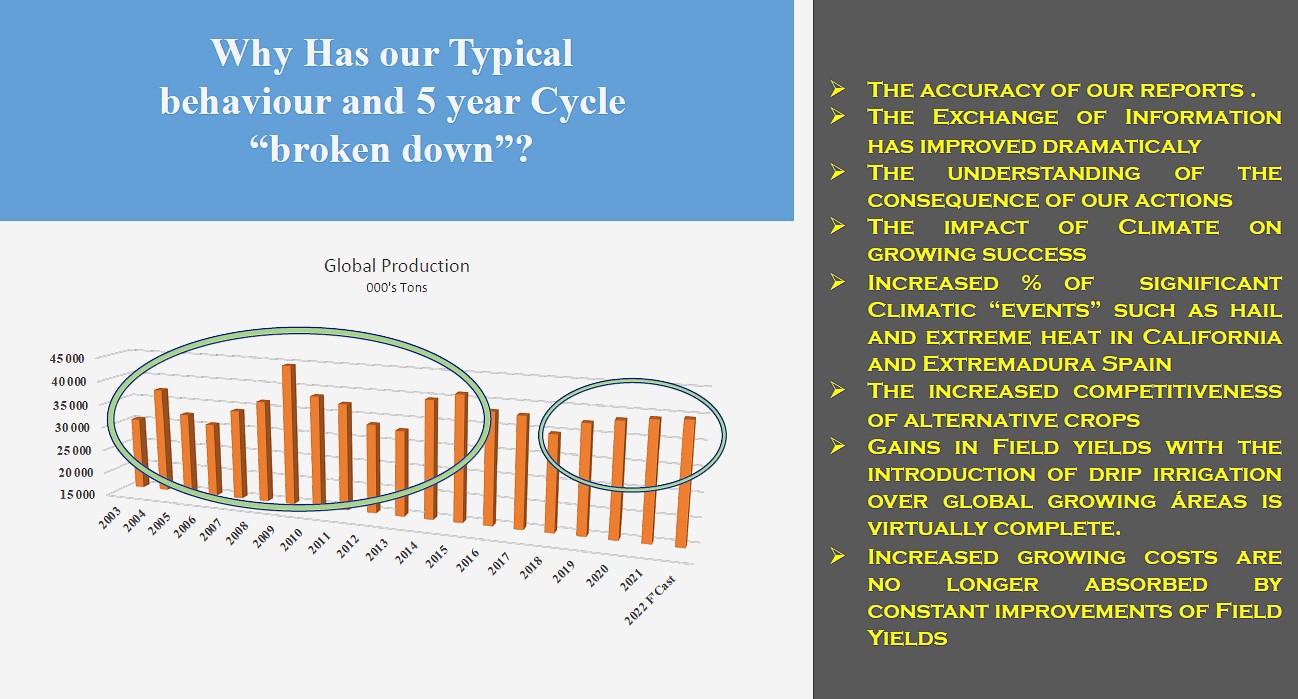

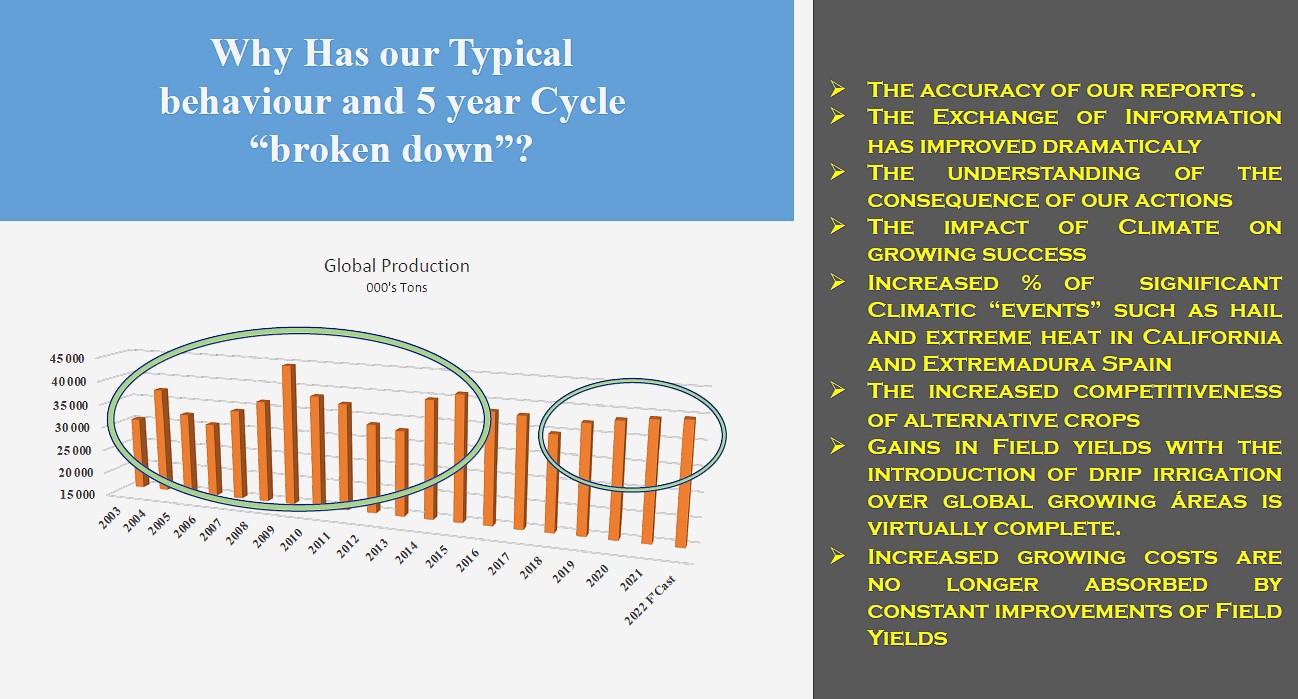

Now, you will all know the five-year cycle that we got so used to, which is based on our behavior as producers and sellers of this product and I think this is broken down – I think it is obvious to most people, we are no longer in such a cycle and you can ask why. The reasons are the accuracy of the information and the exchange of information which has improved significantly, the fact that we talked about this five-year cycle and the impact it has on our business – I think - it can start to affect our plans and how we react to shortages, the impact of climate – we have found that in years where we aim to produce more climatic events have artificially or naturally reduced the quantity we produce, the increased competitiveness of alternative crops - and it is not the increased competitiveness – it is the lower risk of other crops and then the gains in field yields which we saw largely as a result of the introduction of drip irrigation around the world and which essentially has that improvement has run its course. So that whereas we saw very significant increases in previous years, potential increases are now small; and of course the increased growing costs which were absorbed by improved yields are no longer so. So we face a more difficult situation or our farmers face a more difficult situation.

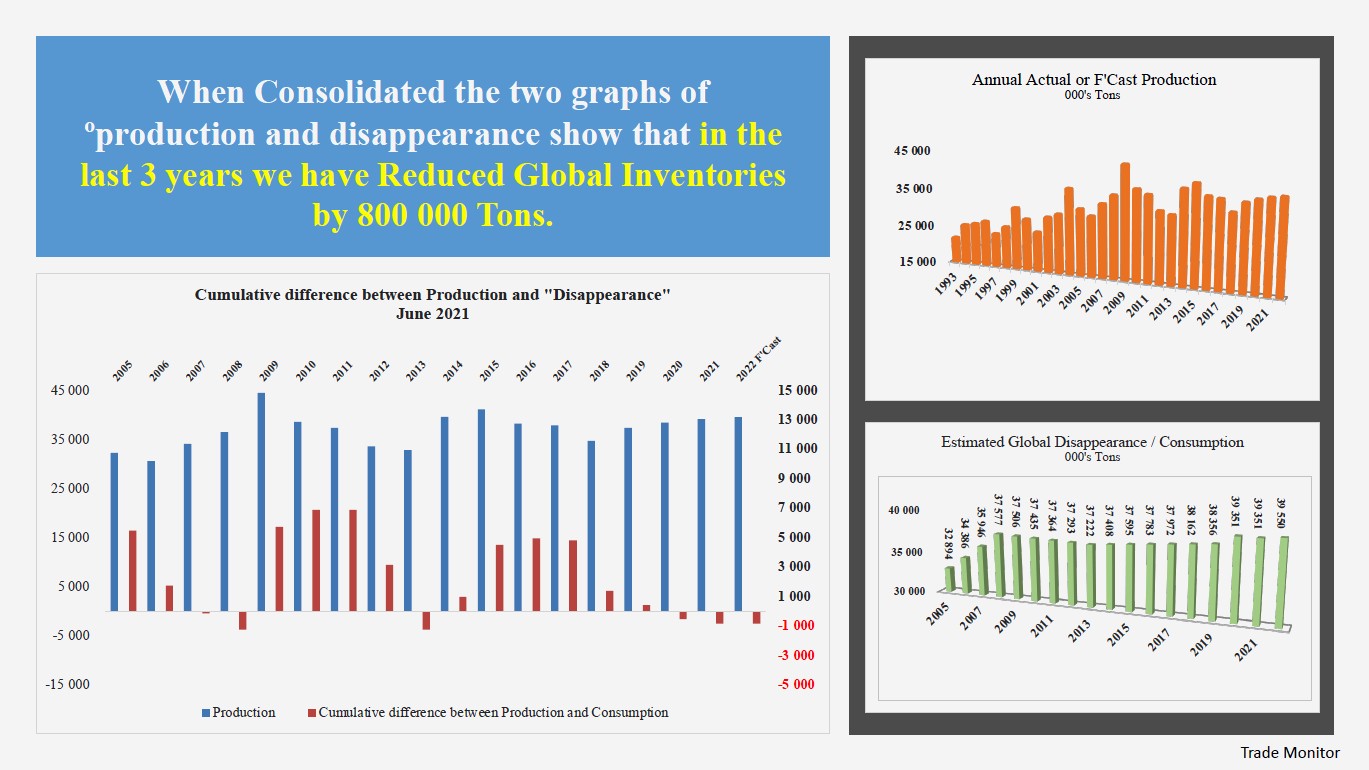

Now if we look at our production (which is in this graph on the right), and estimated consumption and we integrate the two, we can see in the red histograms the excess or insufficient stock that we have on hand or inventory and it is interesting that over the last three years we have reduced our global inventories by 800 000 tonnes; thinking about 2008 which is I think an important reference for us because it was followed by such a significant depression, we have a very different situation: 2008 was followed by 2009, a huge crop which generated a lot of inventory, and then it took us one, two, three, four years before we eliminated the excess inventory, largely because consumption fell as well.

Now, what could happen this year?

Go back a little bit on what I said before, we are obviously concerned about what is happening in Iberia, in Portugal and Spain, but it is interesting that in looking at this, the drought is extremely serious also in Algeria and Tunisia, both of whom are significant producers of tomatoes. So could we see some problems there as well?

California: there the drought is so severe, will they plant everything? As I said I don’t believe that they will plant the 240 000 acres;

Now looking forward to 2023, it is quite the similarities in terms of the price of oil and what is happening happened to us in 2008 is quite significant; and what I am anxious to avoid is that we don’t have the same situation that we faced in 2010, 2011, 2012, 2013… We have very high inflation rates. The last time inflation was controlled by the collapse of Lehman Brothers, by a world banking crisis, and by the European sovereign debt crisis, which we are not thinking so much about but which is still… Southern European countries still have very significant levels of debt and if interest rates rise I think we could face difficulties there.

So I do think we are going to face in the next years a cost of living crisis: the cost of food in general is going to rise very significantly but we go into this in a relatively favorable position: our market is growing, slowly and steadily, but there is an enormous difference against the last time this happened, which is our inventories: our inventories are extremely low and as we focused in the previous presentation on global commodity markets, food in general is… from what appeared to be a surplus we were moving into a significant deficit. It is quite interesting to listen to people talk about the rising commodities because you hear many of the things that we heard in 2008, which was the use of corn and sugarcane, sugar beet to produce bioethanol as a fuel replacement because the peak in the price of oil.

So all those thing are happening at the moment, of course aggravated by the war in Ukraine and the sanctions on Russia.

So, going forward, to leave you with a comment which is basically from Churchill - which you will all know I am sure – “Those who failed to learn from history are doomed to repeat it”. As I said, I think we were in a better position that we have learned from history and I think if we manage to watch our inventories carefully we should be cautiously optimistic. As I close I should say that we should not forget Ukraine and each one in what he can do should work and pray for peace. We must do what we can to help the millions of homeless frightened and hungry.

Some complementary data

Questions: one person was asking what you mean by the five-year cycle…

Up until 2014, 2015, from the late 1990’s, our industry ran in a five- sometimes six-year cycle, basically in response to supply and demand and essentially what happened is that if we start with a bumper year in which there were high yields and high production, a lot of stock - a lot of inventory – was produced and then prices fell; production fell as a result and it took basically four more years before we had another peak and the we would repeat the cycle. We talked over the years a lot about the five-year cycle and I think partly as a result of that it is disappearing. People are more conscious of where we are and more cautious in judging what they will produce; there is also another effect, is that nature has tended to take a hand and to limit production last years.

Questions: what do you believe the three or four innovation that we should make as an industry in the next few years?

To find some way to cut our energy costs will be the Number One. Energy costs are enormous at the moment, we are relatively high users of energy and so that becomes a very high priority. The other point is in a sense the reverse of the statement I made in the presentation, which is improvement in yields - some innovation in new varieties which were able to step up the level of productivity, which would probably be Number Two. It would require more time to think about the third…

Video is available at:

https://www.youtube.com/watch?v=1DXWTJpIgmE

Sources: World Processing Tomato Congress (whova.com)

Talking you today is a particularly difficult task as we are looking hopefully at the end of the Covid pandemic, we are living with an unstable climate, we are seeing really quite extraordinary inflation in our costs, and then finally we have the tragedy of then Ukraine. On the other hand our consumption continues to grow, and I would like to look forward and think together with you as to why production has been unable to increase to meet increasing demand. And to talk a little bit about the impact of massive cost increases which we are bearing will have on our consumers.

Talking you today is a particularly difficult task as we are looking hopefully at the end of the Covid pandemic, we are living with an unstable climate, we are seeing really quite extraordinary inflation in our costs, and then finally we have the tragedy of then Ukraine. On the other hand our consumption continues to grow, and I would like to look forward and think together with you as to why production has been unable to increase to meet increasing demand. And to talk a little bit about the impact of massive cost increases which we are bearing will have on our consumers.