15% drop in inventories, with surplus figures still negative

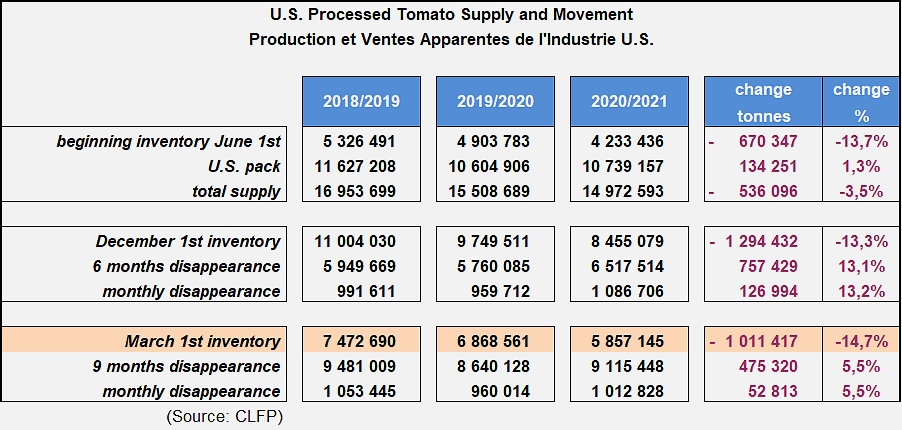

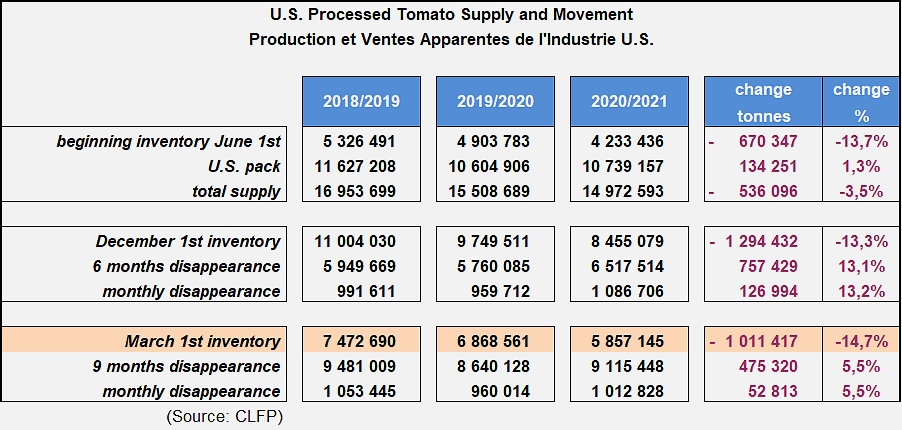

According to a report released on 23 March 2021 by the California League of Food Producers, total inventories of processed tomato products in the United States as of 1 March 2021 were estimated at around 5.86 million metric tonnes (mT), expressed in fresh tomato equivalent. These stocks, which describe the quantities physically present at that date in the processor’s warehouses (except those already sold), are down 14.7% compared to volumes for the same period of the previous year (2020). Apparent consumption of tomato products increased by 5.5% compared to the March 2020 estimate, with a total quantity of approximately 9.11 million mT absorbed during the nine-month period from 1 June 2020 to 1 March 2021, compared to the previous reference period (2019/2020).

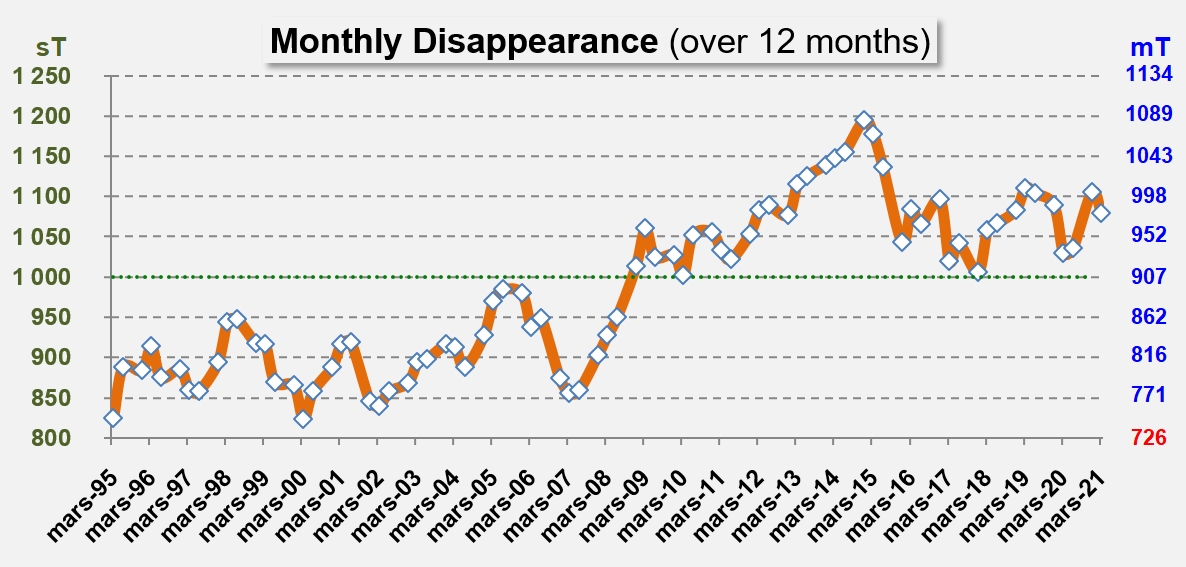

Over twelve months, apparent consumption amounted to 11.75 million mT, up 540,000 mT (4.8%) compared to the situation in March 2020 (see additional information).

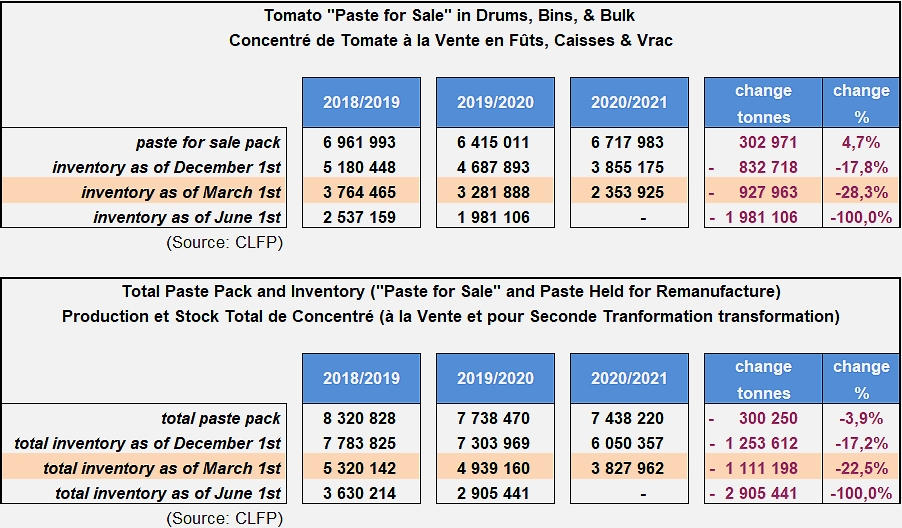

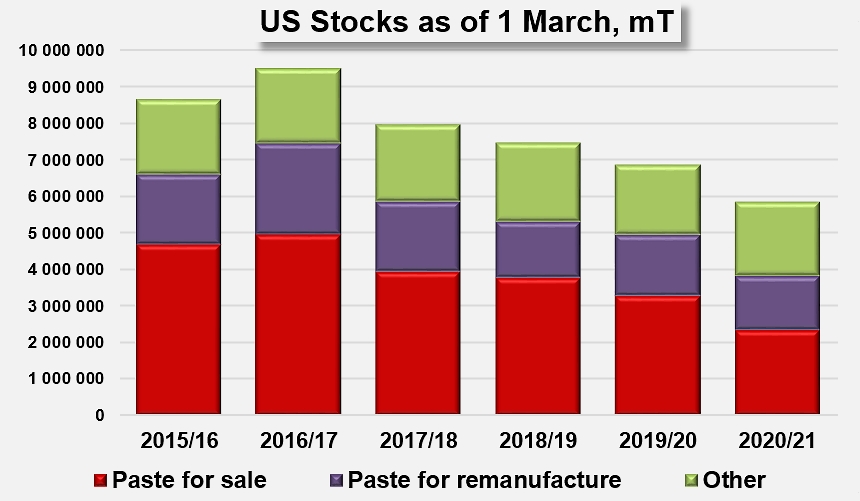

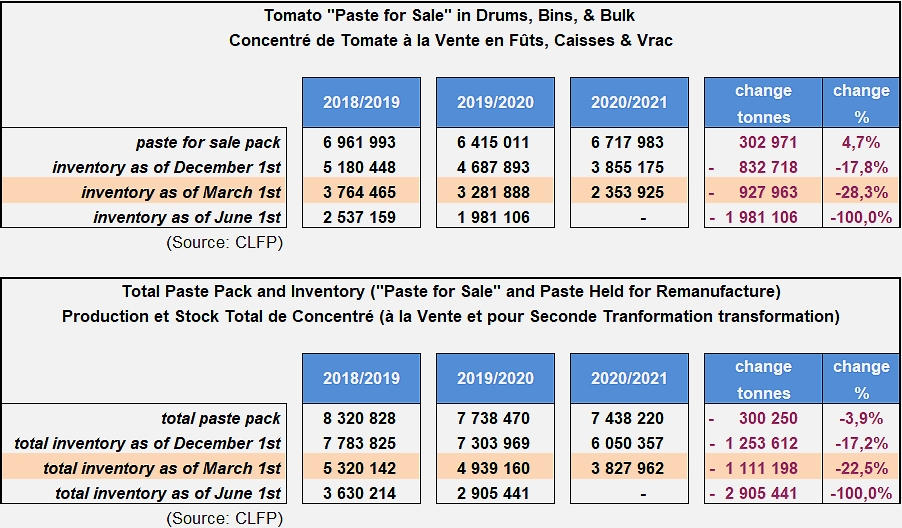

Total inventories of bulk concentrated tomato puree, including stocks held for remanufacture, have been estimated at approximately 3.83 million metric tonnes, based on a “paid tonnes” of raw product equivalent, as of 1 March 2021. These volumes represent approximately two thirds of the quantities held by US companies, and have fallen sharply since their peak in March 2017 when they reached the equivalent of nearly 7.5 million mT of fresh tomatoes.

US inventories of bulk tomato paste for sale as of 1 March 2021 were estimated at approximately 2.35 million metric tonnes, based on a “paid tonnes” of fresh tomato equivalent. This figure is nearly 930,000 mT (-28%) lower than on 1 March 2020.

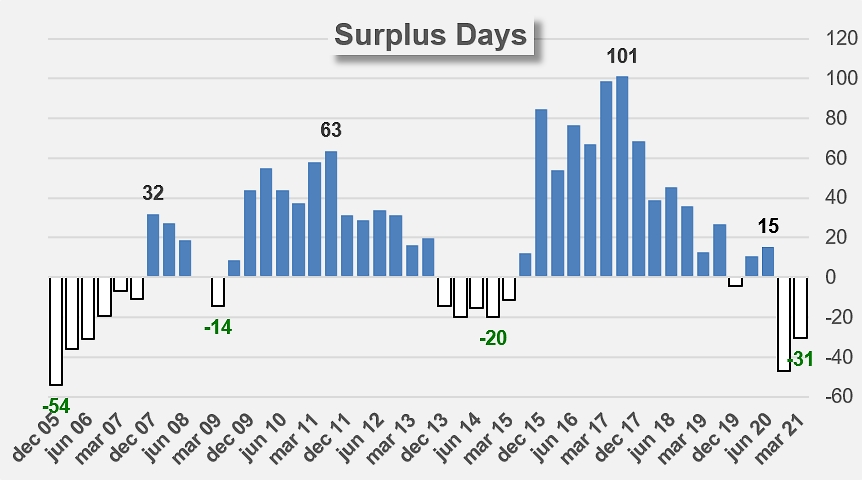

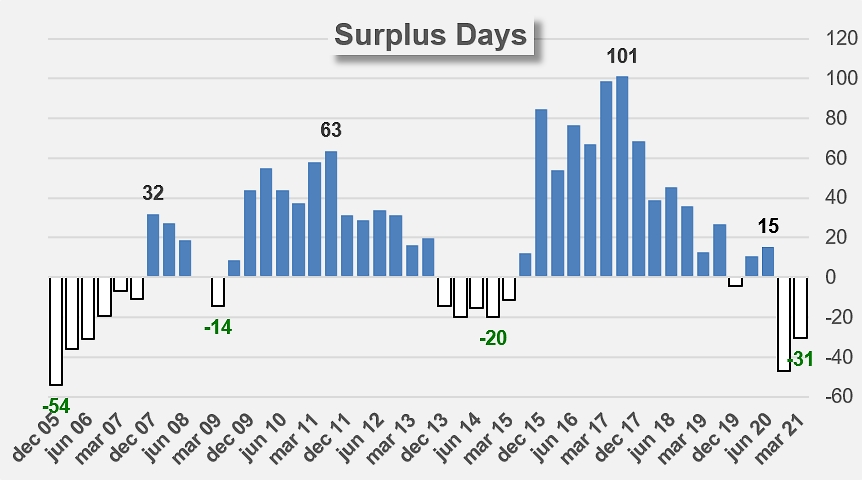

As they stand, the physically available quantities are slightly lower than the theoretical needs of the domestic and foreign markets served by the US industry; more precisely, the 5.6 million mT currently available in processed forms should make it possible to meet demand until around the end of August 2021, whereas the deadline generally considered as necessary to meet requirements with products from the previous year's crop is usually end of September or beginning of October.

At the rate of consumption recorded over the last nine months, projections estimate apparent annual disappearance at around 12 million mT (perhaps even slightly more), a level that is 700,000 mT (fresh tomato equivalent) higher than recorded in June 2020, after the start of the Covid pandemic. From this perspective, stocks on 1 June could be between 2.95 and 3.05 million mT, a historically low level, as it is necessary to go back fifteen years (in 2006/2007) to find a figure that is lower (in a context that was radically different, including in economic, demographic, and agro-industrial terms).

This level of consumption should also be compared with US processing intentions for the upcoming crop (10.97 million mT in California and 0.47 million mT in all of the other processing States, i.e. 11.44 million mT in total, as defined in the WPTC crop estimate of February 2021), which leave a “margin” of a few hundred thousand tonnes that can be attributed to uncertainties linked to the conditions of a possible exit from the Covid crisis, as well as to the evolution of the USD/EUR/CNY exchange rates and their effects on the future competitiveness of US products.

Additional information:

Apparent disappearance over the past twelve months

Evolution of inventory components on 1 March over the last six years

Source: CLFP

Further details in the attached document: